Kotak Securities Review : Commodity, Equity, Futures, Options

Kotak Securities is a subsidiary of Kotak Mahindra Bank was founded in the year 1994 and is a bank based full-service stockbroker.

The broker provides investment and trading services in variety of financial products to its clients.

The variation is that wide that it even provides portfolio management services to its HNI clients.

Kotak Securities claims to have a client base of around 12 lakh and running over 5 lakh trades on daily basis.

The stockbroking firm has a sound offline presence in around 360 cities in India with 1255 branches.

It provides 3-in-1 Demat account which basically smoothens the overall fund transfer process between the trading and Demat accounts.

Moreover, it provides Kotak NRI Trading account for Indian traders living outside India.

Kotak Securities Products

It has a membership of Bombay Stock Exchange (BSE), National Stock Exchange (NSE) :

- Equity

- Derivative Trading

- Mutual Funds

- IPO

- Kotak Demat Account

- ETF (Exchange Trade Funds)

- Currency Trading

- Tax-free Bonds

- Portfolio Management Services

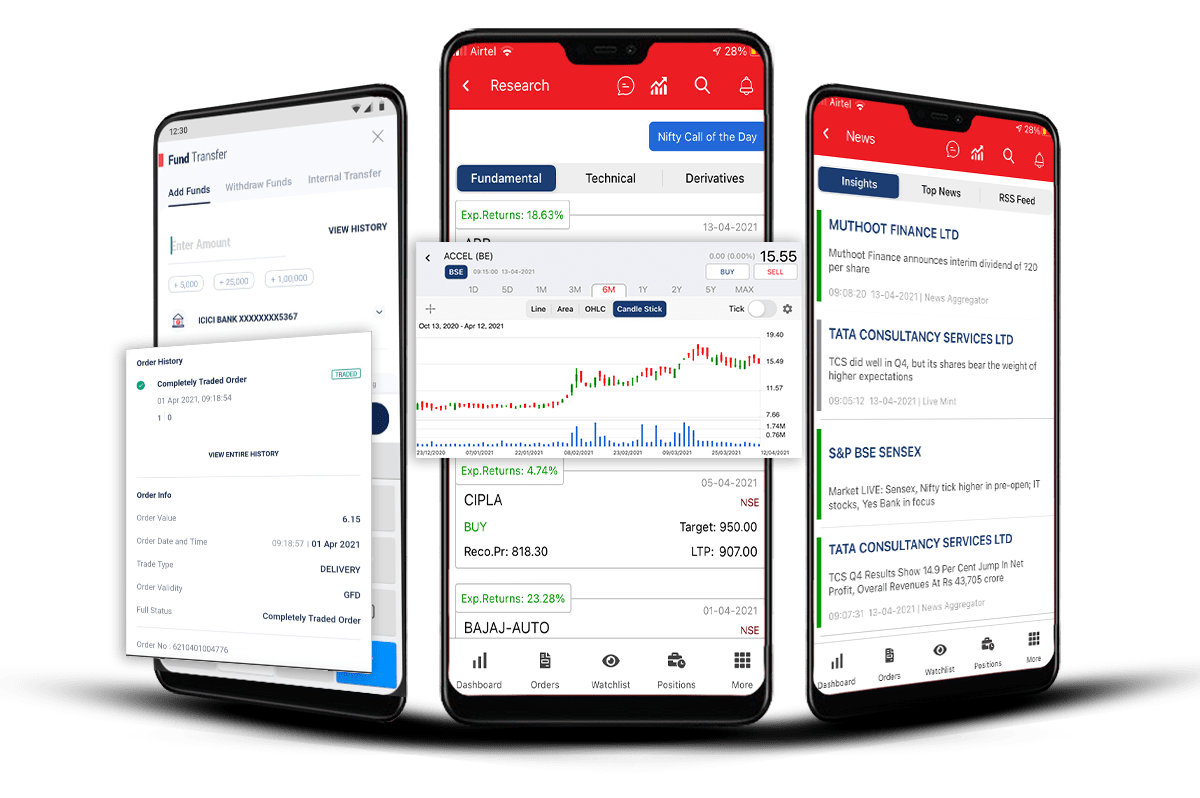

Kotak Securities Apps

Kotak Securities offers 5 different trading platforms across devices to its clients to trade. It provides a trading terminal, a mobile trading app, web trading and lighter versions of their trading software.

Kotak Stock Trader Web

Kotak Securities through their browser-based trading application allows its clients to trade directly through website. You don’t need to download or install any particular software to start trading through this cloud based trading solution.

Kotak Securities Xtralite

Users with a relatively slower internet connection or from remoter areas of the country can use a lighter version of the web trading application – XTRALITE. The application allows you to trade in equity and derivative trading segments.

Some of the features of this application are:

- Works with complete responsiveness across devices be it mobile, desktop, laptop or tab.

- Order monitoring and placing order features.

- Get market research reports to make sound trading and investment decisions.

Keat Pro X

Keat Pro X is an installable trading terminal for serious traders. It is a full fledged trading platforms with all major features that are must for such an application:

Best of the research reports and market tips within the software that help you in taking the right decision at the right time.

Get access to market information with real time stock movements, top gainers and losers, updates on various indices etc.

Personalised watchlist feature that allows you to add up to 100 scrips within a watch list. Users can combine scrips across BSE, NSE and currency segments.

Interactive charts and graphs to make the client’s life easier.

The trading software can be installed by logging into the Kotak securities web platform, click on ‘Trading Tools’ and select KEAT Pro X. The application can be run on both Windows and Mac OS.

Kotak Securities Fastlane

If the user has old or just has very slow speed or your office network infrastructure does not allow you to download software – then Fastlane is just the right thing for you. This is a light java based trading application that takes minimal of machine’s processing speed and still runs at a good speed.

Fastlane comes with the following features :

- Access to company reports and market research.

- A list of S&P CNX NIFTY scrips stream LIVE on it by default.

- Unlimited Watchlist.

Kotak Stock Trader

Stock trader is a mobile trading app and it allows clients to trade across equity, derivatives, and currency and also has features such as access to live market trends, Portfolio tracking etc.

Detailed features of the mobile trading app are listed below :

- Customised watch-list creation

- Funds transfer

- Connected with Live TV (Provided by Bloomberg)

- Multilevel Security

- Get live market updates through integration with Times Of India, Economics Times, Money Control.

- Trade rectification and cancellation allowed through the mobile app itself.

- Intraday charting facility is available

- Stop loss provision.

Kotak Trade Smart

This is another application from Kotak for multiple options. The platform allows traders to analyze at both technical and fundamental levels.

Kotak Securities Customer Care

Kotak Securities offer customer support services.

If anyone wants to avail information related to the trading account, product information, or technology platforms etc then you can call them from Monday to Friday between 9:00 AM to 6:00 PM. Kotak Securities Call and Trade facility is also there for the users to make trades offline.

The bank based stockbroker provides following channels of communication to its clients

A toll free number (1800 209 9191/ 1860 266 9191) with support in 10 different languages.

- Email Support

- Web assistance

- Phone

- Offline Branches

- Webchat

Kotak Securities Research

The full service stock broker provides research and recommendations at multiple levels as listed below :

Investor’s Research

This is done at the fundamental level for clients who are looking for long-term investments including :

- Fundamental Research

- Macroeconomic Research

- Industry or sector Research

- Company research

- Special reports

- Morning insights

- Stock Ideas

- Derivative reports

Kotak securities provides trading and investment education to its clients through different modes. It contains multiple modules :

- Equity Section

- Derivatives

- Mutual Funds

- Financial Planning

- Kotak Securities Videos

- Fundamental analysis of stocks

- Technical analysis of stocks

Kotak Demat Account

Kotak Securities Demat Account Offers many benefits

- Post Kotak Securities Account Opening, you can link all your accounts.

- Apart from this, there are other benefits associated with it.

- Helps in doing an in-depth analysis and stock recommendation.

- Completing trade within minutes.

- Offers free intraday trading by paying Rs 999/year.

To open a demat account one need to submit few documents like:

- Identity Proof

- Address Proof

- Income Proof

- PAN Card

- Photographs

Kotak Securities Charges

Kotak Securities has one of the most expensive stock in India across all dimensions including account opening, maintenance, brokerage and so on.

Kotak Securities Account Opening Charges

Kotak Securities offers the service to open a stock trading account and the Demat account service.

All these involve certain charges and commissions.

| Transaction | Fees |

| Trading Account Opening Charges | Rs 750 |

| Trading Annual Maintenance Charges | Rs 0 |

| Demat Account Opening Charges | Rs 0 |

| Demat Account Annual Maintenance Charges | Rs 600 |

Kotak Securities Demat Account Charges

To open Demat and trading account, here are the initial charges a client needs to take care of :

| Dematerialisation | Rs. 150 per certificate + 50 per request courier charges |

| Rematerialisation | Rs. 10 for 100 securities |

| Pledge Charges | Rs. 20 per ISIN |

| Invocation Of Pledge | Rs. 20 per ISIN |

| Charges For Client Master Change (Applicable For Address, Email, Mobile and Bank Updation) | Rs. 50 per modification request |

| Charges for CAS | Rs.200 per statement per year + Rs.50 courier charges |

Kotak Securities Brokerage

When it comes to brokerage fees, it becomes important to understand how does Kotak Securities charges brokerage as the broker offers multiple brokerage plans.

1. Kotak Securities Trade Free Plan

The trade-free plan is beneficial for intraday trader as this plan comes with the benefit of free intraday trading.

Special features of this plan:

- Free Account Opening

- AMC: Rs 50 per month

- Validity: Lifetime

- MTF: 12.49% per annum.

Stock used as margin for Derivatives Trade: 16.99% per annum (applicable only on non-cash collateral limits used above 50% of the total margin requirements)

| Trading Segment | Brokerage |

| Equity Delivery | 0.25% or Rs.20 whichever is higher. |

| Equity Intraday | 0 |

| Equity Futures | Rs.20 per order |

| Equity Options | Rs.20 per order |

| Currency F&O Intraday | 0 |

| Currency F&O Delivery | Rs. 20 per order |

| Commodity F&O Intraday | 0 |

| Commodity F&O Delivery | 0.25% |

| Commodity F&O Intraday | 0 |

| Minimum Brokerage | Rs. 20 |

2. Kotak Securities Trade Free Max Plan

Users who are into margin trading and looking for the MTF at the minimum rate, Kotak has the plan for your needs. The users can enhance their buying power as the broker offers them the margin funding at the minimum interest of 8.75% per annum.

Also, by subscribing to this plan, Users can reap benefit of brokerage cashback of up to Rs. 4,128 for 90 days on all trades post first MTF Trade.

Some of the features of the trade free max plan are as follows :

Free Account Opening

- AMC Charges : Rs. 50 per month

- Subscription fees : Rs. 2499 per annum

- Validity : 1-year

- MTF : 8.75% per annum

Stock used as margin for derivatives trades : 16.99% per annum

| Trading Segment | Brokerage |

| Intraday | Free |

| Equity Delivery | 0.25% or Rs.20 whichever is higher |

| Futures | Rs. 20 per trade |

| Options | Rs. 20 per trade |

| Carry Forward | Rs. 20 per trade |

3. Kotak Securities Zero Brokerage Plan

The Zero Brokerage Plan is for traders who are less than 30 years of age. With this plan, the trader can reap the benefit of free trading across segments. There is an annual subscription fee of Rs 499 + GST.

The features of this plan :

Zero account opening

- AMC Charges : Rs.50 per month

- Subscription Fees : Rs. 499

- Validity : 2 years

- MTF : 12.49%

Stock used for margin for derivatives trades : 16.99% per annum (applicable only on non-cash collateral limits used above 50% of the total margin requirements.

4. Kotak Securities Dealer Assisted Plan

This is a beginner friendly plan. Users can avail the benefit of trading with Kotak Securities at minimum brokerage along with the services of the dedicated dealer.

| Trading Segment | Brokerage |

| Equity Delivery | 0.039% of the turnover or Rs. 21 whichever is higher |

| Equity Intraday | 0.039% of the turnover or Rs. 21 whichever is higher |

| Equity Futures | 0.039% of the turnover or Rs. 21 whichever is higher |

| Equity Options | Rs 39 per lot |

| Currency Futures | Rs 9 per lot or Rs 21 whichever is higher |

| Currency Options | 0.039% of the turnover or Rs 21 whichever is higher |

| Commodity Options | Rs 39 per lot |

Kotak Securities DP Charges

| Charge Type | Charges | Minimum Charges |

| Dematerialisation | Rs 50 per request and Rs 3 per certificate | NA |

| Rematerialisation | Rs 10/- for 100 securities (shares, bonds, mutual funds etc.) | Rs.15 |

| Regular (Non – BSDA Account) Market / Off -Market transactions (Sell) BSDA Account (For Individual accounts only)/ Market / Off Market Transactions (Sell) | 0.04% of the value of securities (plus NSDL Charges) 0.06% of the value of securities (plus NSDL Charges) | Rs.27 (Plus NSDL Charges as applicable) Rs. 44.50 (Plus NSDL Charges) |

| Regular Account Maintenance Charges | Resident Rs 65 p.m for upto 10 debit transactions Rs 50 p.m for 11 to 30 Debit transactions Rs 35 p.m for more than 30 debit transactions NRI – Rs 75 p.m | NA |

| Pledge Charges | 0.05% of the value of securities | Rs. 30 |

| Invocations Of Pledge | 0.04% of the value of securities | Rs. 30 |

| Charges For Client master change (Applicable For Address, Email, Mobile and Bank Updation) | Rs.49 per modification request | NA |

| DIS Re-Issuance | Rs. 99 per DIS booklet | NA |

| Charges For CAS | Rs. 3 per month | NA |

Kotak Securities Margin Calculator

The broker also offers the service of Margin Trading Funding of 8.49% as a part of paid feature.

| Equity | Up to 15 times for intraday, For delivery up to 3 times |

| Equity Futures | Up to 5 times Intraday |

| Equity Options | Buying No Margin, Shorting up to 2 times for intraday |

| Currency futures | Up to 2 times intraday |

| Currency options | Buying no margin, shorting up to 2 times for intraday |

| Commodity | Up to 2 times intraday |

Kotak Securities Pros and Cons

| Disadvantages | Advantages |

| Brokerage charges are relatively high, especially with the availability of discount brokers. | 3-in-1 account provision available due to kotak securities backing from Kotak Mahindra banking services. |

| DP Charges have complained few times for its non-transparency in the recent past | Trading platforms across devices available even with the lighter versions that can be used at remote locations |

| The broker doesn’t allow its clients to trade in the commodities segment. | Online chat is available. |

Kotak Securities Rating

| Parameter | Rating |

| Trading Platforms | 7.0/10 |

| Research & Tips | 6.5/10 |

| Pricing & Brokerage | 6.5/10 |

| Customer Service | 7.0/10 |

| Exposure | 6.0/10 |

| Overall rating | 6.6/10 |

This was Kotak Securities Review. We hope that you found this article useful. Please share your article and stay tuned for more updates.

Get access to market news, updates and trends; follow our telegram channel@onlinetradinginstitute

| Disclaimer: The sole purpose of our financial articles is to provide you with educational and informative content. The content in these articles does not intend any investment, financial, legal, tax, or any other advice. It should not be used as a substitute for professional advice or assistance. |